Depending on who you ask, it’s not a question of if, but rather when, the United States will enter a recession in the near future. Certainly, many economic indicators are pointing in that direction.

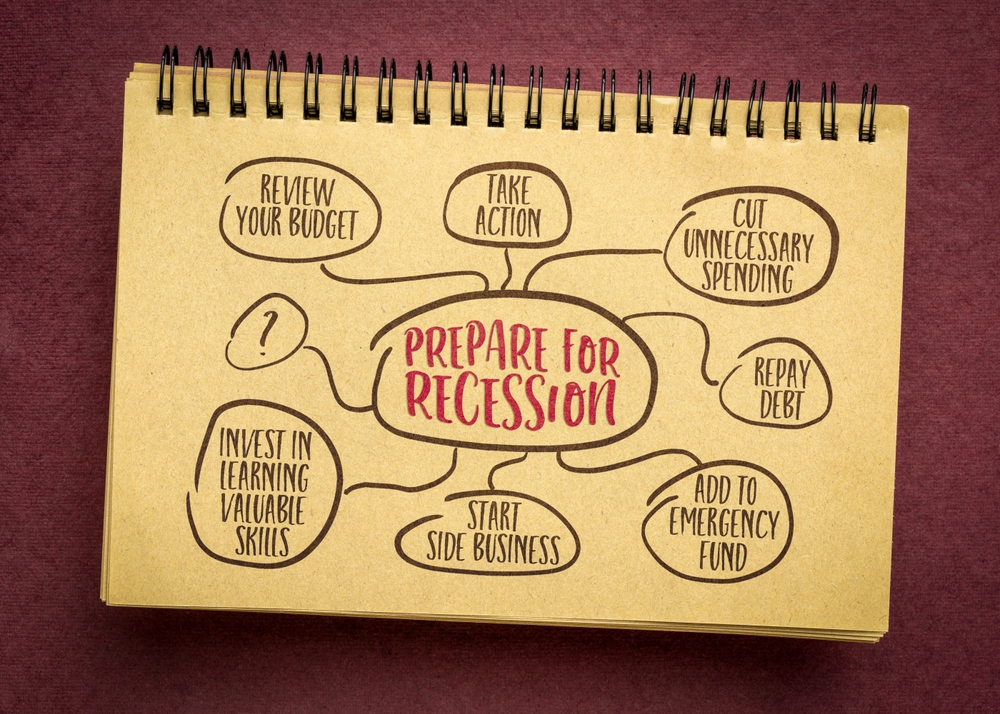

While no one can say for sure what the future will bring, it’s best to heed the warning signs. Here are some of the best tips from Forbes Advisor and finance experts to help you prepare for a recession.

Manage Your Money Wisely

Your chances of successfully weathering a recession are higher if your financial house is in order. If you’ve been taking a lax approach to your money, start with these essential tasks.

1. Create a Budget

Having a budget is money management 101, and something that can benefit every household. It gives you a “good sense of what it costs to run your life,” according to Sara Stanich, founder of financial planning firm Cultivating Wealth in Montauk, New York.

Budgeting doesn’t have to be difficult, and it can be accomplished in seven simple steps that cover the process of adding up your expenses and income and then reconciling the two. There are also multiple ways to implement a budget, so explore your options to determine which one appeals to you most.

2. Eliminate As Much Debt As You Can

As interest rates climb, so too does the cost of debt. And if you’re spending a large portion of your income on credit card and loan payments, that leaves little to save for a rainy day. Eliminating debt is an important part of how to prepare for a recession, and a debt snowball can be an effective method to use.

Of course, not everyone will be able to get out of debt before a recession hits. “If you do carry a balance, it’s good to (find) a low-interest, fixed-rate offer,” Stanich says. However, offers like this are typically reserved for applicants with very good credit.

Consolidating debt to a fixed rate loan may save money on interest and can also make for predictable monthly payments, which can help with budgeting during a recession.

3. Create an Emergency Fund

Recessions are often marked by job losses, so now is the time to shore up your cash reserves.

“Think about giving yourself [enough savings to cover] a couple of payrolls,” says Amy Mosher, chief people officer at isolved, a firm providing workforce management solutions. If necessary, consider pulling back on your 401(k) contributions temporarily to build up an emergency fund. “It can relieve a lot of stress,” according to Mosher.

Saving Money During Tough Times

Ideally, you’ll head into a recession with no debt and with a fully funded emergency account. But that might not always be possible. “You might not have time to build savings,” before a downturn, says Dustin Smith, senior vice president and financial advisor at Wealth Enhancement Group in Plymouth, Minnesota.

If you can relate, use these tips to rein in spending prior to a recession.

4. Pare Down Expenses

There are many ways to save money without affecting your lifestyle. Those strategies include shopping for less-expensive cell phone service, bundling insurance policies and using bill negotiation apps. Also, don’t forget all the services you signed up for but never use.

“Do an audit of credit cards for recurring subscriptions,” Stanich advises.

Many households pay for multiple streaming services, automatic deliveries and online or offline memberships. Eliminating a handful of these recurring charges could easily reduce your monthly bills by $100 or more.

5. Rethink Big Purchases

Money saving tips often focus on eliminating small expenses, such as a morning latte, but Smith says this approach can only save you so much cash. Instead, he asks people to consider whether they can skip a major purchase such as a second home or new car. “That’s [the equivalent of] a lot of cups of coffee,” he notes.

With a possible recession looming, think twice before buying something such as a boat or timeshare that will result in ongoing bills. Likewise, skip a luxury vacation or other expense that could wipe out your savings account.

6. Learn to Cook at Home

Food is often one of the largest discretionary expenses in a household budget. And much of the spending growth in this category is fueled by dining out. The federal Bureau of Labor Statistics found that American spending on food away from home—which includes takeout and delivery— jumped 27.6% in 2021 compared to the previous year.

Eating at home can be cheaper than takeout or restaurant fare, and brushing up on your cooking skills could save you hundreds, if not thousands of dollars during a recession. You can eat healthy on a budget if you know the right tips and tricks.

Investing During a Recession

A recession typically means a declining stock market, so you need to be smart about how you manage your investments in the next few years.

7. Move Your Savings

The silver lining to rising interest rates is that many savings products are now paying more. “Banking savings is actually competitive again,” Stanich says.

She has seen high-yield savings accounts paying out 3% interest and CDs with rates of 4%. I bonds, which have a rate that is adjusted every six months to account for inflation, are currently earning nearly 7%.

If you have money languishing in an account that isn’t earning interest, now might be the time to move that cash elsewhere. You won’t get rich off these savings products—and be aware there are withdrawal restrictions on CDs and I bonds—but they are a safe way to grow your balance during a recession.

8. Convert Retirement Funds to Roth Accounts

In the event you’re laid off or have your hours reduced, see it as an opportunity to reorganize your retirement savings. Low-income years are the perfect time to complete a Roth conversion.

“You’d rather have your money in a Roth account where it will grow tax-free,” Smith says.

Moving money from a traditional IRA or 401(k) account to a Roth account means you’ll have to pay regular income tax on the amount converted. A low-income year could mean you’ll pay those taxes in a lower bracket.

9. Stay the Course With Investments

While you may want to reorganize which type of account you keep your money in, it’s usually best not to make dramatic changes to an investment strategy during a recession. In fact, the worst thing you can do is pull money out of the market during a downturn.

“The problem is you have to be right twice,” Smith says. “You have to be right when you get out and right when you get back in.”

If you cash out investments during a stock market correction, you could lock in your losses. Even if you manage to withdraw money prior to a plunge, you could miss the rebound. In fact, some of the best trading days to be in the market—when investments grow the most—happen right after the worst days.

10. Consider Tax-Loss Harvesting

If you do need to sell investments during a recession, consider those that will allow for tax-loss harvesting, Smith advises. This strategy involves selling equities for less than you purchased them and then writing off the loss on future tax bills.

Be sure you understand how the wash sale rule works, though. You can’t turn around and repurchase the same equities you sold for a loss. Doing so makes the sale ineligible for the tax write off.

Recession Tips for Workers and Retirees

When the economy shrinks, there’s always the risk that employers will shed jobs. Here are some tips for those who are in the workforce and those who are getting ready to leave it.

11. Make Yourself Indispensable at Work

There’s been a lot of talk lately about “quiet quitting,” the practice of doing just the bare minimum at work. However, if you think your job might be on the line during a recession, you want to take the opposite approach: Become the type of employee who is a team player and always ready to do their part.

“I would keep a less skilled employee that I know would raise their hand and have a better attitude,” Mosher says.

In the event you are laid off, don’t leave work without asking your employer key questions such as when your benefits will end and whether you can get a letter of recommendation.

12. Delay Your Retirement

If you were planning to retire next year, it may be better to push your final day back until the economy rebounds.

“Retiring in a down market isn’t so wonderful,” Smith says.

Once you leave the workforce, you may need to dip into your retirement funds to pay bills, and making withdrawals early in retirement during a down market could leave you strapped for cash later in life. Learn about sequence of returns risk and then decide if you can stomach another year or two in the workforce.

13. Start Social Security Early

Some people can’t—or won’t—delay retirement. In that case, consider starting your Social Security benefits early if you’re at least age 62.

“Starting Social Security early might reduce pressure on investments,” Smith says. Those monthly payments might be enough to cover essential bills or at least reduce the amount that needs to be withdrawn from your retirement accounts each month.

Taking Social Security early does mean you’ll receive a reduced benefit, so be sure you understand how payments will be affected if you start your claim before full retirement age (67).

14. Start a Side Hustle

Working part time is another way to reduce your need to pull money from retirement accounts during a recession. It doesn’t have to be a traditional job, either. There is no shortage of apps, from DoorDash to TaskRabbit, that allow people to make money doing things like delivering fast food meals and assembling furniture on their own schedule.

In fact, side hustles can be a smart move for anyone who is trying to boost savings or reduce debt before a recession. Money-making options include many jobs that can be done online or from your home.

Controlling Your Housing Expenses

Your house and mortgage are likely your biggest expenses. During a recession, use these tips to save money.

15. Don’t Move Right Now

Many experts agree: A recession doesn’t equal a housing crisis. But that doesn’t mean you should plan a move right now either, especially if you’re a retiree.

“Downsizing is not the obvious thing to do anymore,” Stanich says. People often move in retirement to reduce expenses, but rising mortgage rates may mean you end up with a smaller house and a larger mortgage payment.

Still, not everyone is in a position to delay a move. If you do need to buy a house, be sure to compare mortgage rates to find the best offer.

16. Get Rid of Your PMI

Anyone who buys a home with a down payment of less than 20% probably has private mortgage insurance (PMI) attached to their loan. This insurance can add hundreds of dollars to your monthly payment.

Fortunately, lenders are required to cancel PMI once you have 20% equity in your home. Normally, this would be best accomplished by making extra payments toward the loan’s principal. However, the recent rapid increase in housing prices could be enough to increase your equity to that level without any extra payments.

You may have to pay for an appraisal to prove that’s the case, but it could be money well spent if your PMI payments are significant.

17. Reduce Your Energy Costs

Weatherizing your home is another smart strategy for those preparing for a recession. Sealing windows, changing HVAC filters and clearing out gutters can all save on energy bills and help avoid expensive home repairs in the future.

If you think you’ll have trouble covering your energy costs during a recession, take time to research what assistance is available. Utility companies, the government and nonprofit organizations may all have programs available to reduce costs for those who are income eligible.

Recession-Proof Your Health

You may not think of wellness in financial terms, but staying healthy can have a profound impact on your money situation. Getting sick can mean lost income and high medical bills.

18. Reevaluate Your Insurance Coverage

Each year, take advantage of your open enrollment period to review your health insurance coverage and make changes as necessary.

If you’re on a federal marketplace health insurance plan, open enrollment takes place in the fall. If you get health insurance through work, your open enrollment period could be at any point in the year; ask your human resources department for details.

“One thing that employees can do that makes a material difference is to review benefits,” Mosher says. If you are married, do this together with your spouse to ensure you aren’t duplicating coverages. Mosher notes, “You’d be surprised how many couples are paying for separate insurance.”

Also, see if you signed up for any voluntary benefits in the past that you no longer need. For instance, maybe you are paying for pet insurance through work, but your four-legged friend crossed the rainbow bridge last year. Cancel anything not needed and redirect that money toward savings or paying down debt.

19. Open an FSA or HSA

You could pay for your medical expenses with pre-tax dollars if you have a health savings account (HSA) or a flexible spending account (FSA). Each has their own rules, so make sure you understand the differences. Then, assuming you are eligible, open one of these accounts to save money on medical care next year.

If you have children in day care, many employers also offer FSAs for dependent care. Using these accounts is another way to save money during a recession, but you may want to check with a tax professional to determine whether the FSA or the child and dependent care tax credit is better for your situation. You can’t use both.

20. Make Wellness a Priority

Finally, keep the stress of a recession at bay by making your health a priority. “You really have to take care of yourself,” Mosher says. Many employers offer their workers wellness programs intended to improve physical and mental health, and Mosher says these are often underutilized.

Otherwise, look for easy self-care ideas that can help you cope with difficult economic situations. Going for a walk in the woods, journaling for a few minutes each morning and connecting with friends on a regular basis are all ways to stay grounded in uncertain times.